Thursday, July 30, 2009

Ron Paul: What are they (the Fed) so afraid of?

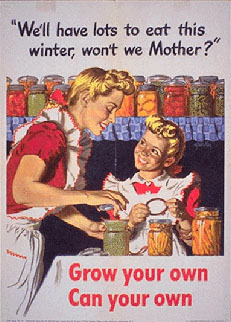

Fresh produce 7.31.09

2. Goldman Sach's record profits (and bonuses) are essentially subsidies. That is to say, their profits are taxpayer dollars.

3. John Stossel ponders outlawing cigarettes. Why not?

4. Capitalism, Jewish Achievement, and the Israel Test: Is Israel a capitalist beacon in the Middle East?

Friday, July 24, 2009

An Overview of the "Audit the Fed" Debate

- The Fed’s discount window operations

- Funding facilities

- Open market operations

- Agreements with foreign banks and governments

Why should we audit the Fed?

In The Case Against The Fed, Murray Rothbard argues that the Fed enjoys a greater secrecy and independence than even the CIA.

The CIA and other intelligence operations areRothbard's first chapter is excellent, and highly relevant to this post. I would strongly recommend reading it in its entirety.

under control of the Congress. They are accountable: a Congressional committee supervises these operations, controls their budgets, and is informed of their covert activities. It is true that the committee hearings and activities are closed to

the public; but at least the people's representatives in Congress insure some accountability for these secret agencies.

...

The FederalReserve System is accountable to no one; it has no budget; it is subject to no audit; and no Congressional committee knows of, or can truly supervise, its operations. The Federal Reserve, virtually in total control of the nation's vital monetary system, is accountable to nobody—and this strange situation, if acknowledged at all, is invariably trumpeted as a virtue.

...

So: if the chronic inflation undergone by Americans, and in almost every other country, is caused by the continuing creation of new money, and if in each country its governmental "Central Bank" (in the United States, the Federal Reserve)

is the sole monopoly source and creator of all money, who then is responsible for the blight of inflation? Who except the very institution that is solely empowered to create money, that is, the Fed (and the Bank of England, and the Bank ofItaly, and other central banks) itself?

Ron Paul articulates:

Claims are made that auditing the Fed would compromise its independence. However, by independence, they really mean secrecy. The Fed clearly cherishes its vast power to create and spend trillions of dollars, diluting the value of every other dollar in circulation, making deals with other central banks, and bailing out cronies, all to the detriment of the taxpayer, and to the enrichment of themselves. I am happy to challenge this type of “independence.”

They claim the Fed is endowed with special intellectual abilities with which to control the market and that central bankers magically know what the market needs. We should just trust them. This is patently ridiculous. The market is a complex and intricate thing. No one knows what the market needs other than the market itself. It sends signals, such as prices, that should be reacted to and respected, not thwarted and controlled. Bankers are not all-knowing and cannot ignore the rules of supply and demand. They might act as if they are, but their manipulation of the market just ends up throwing it wildly off balance, which gives us the boom and bust cycles.

They claim the Fed must remain apolitical. No organization is apolitical that relies on the President to appoint the Chairman. In fact, it is subject to the worst sort of politics – power to create trillions of dollars and affect the value of every dollar in the country without the accountability of direct elections or meaningful oversight! The Fed typically enacts monetary policy that is favorable to particular administrations close to elections, to the detriment of long-term considerations. They do this partly because of the political appointee process for the Chairmanship.

Ron Paul recently articulated the conflict between the people and the Central Bankers in this appearance on MSNBC:

Over at Campaign For Liberty, Peter Orvetti asks "What's the Establishment Got to Hide?"

A dollar today is worth less than one-twentieth what it was worth on the day the Federal Reserve was created 96 years ago. Yet over all that time, the unelected Fed has never had to face the full scrutiny of our elected representatives that other powerful agencies must. Even our intelligence agencies must report to Congress -- but not the Fed, which has helped rack up an $11 trillion national debt, and an additional $13 trillion in dubious loans and bailouts.

The Fed will not say where that money is going. Chairman Ben S. Bernanke has refused to tell Congress, and why should he? There is no means to compel him, and no way to find out what he’s been doing. The Federal Reserve Transparency Act would change that.

C-SPAN covers an excellent debate with Tom Woods and others (including Warren Coats, former IMF official) on the pros and cons of auditing and abolishing the Federal Reserve. The basic positions are:

- Audit and abolish the Fed and replace it with private commodity money and private banking.

- Strip the Fed down to the sole task of protecting the value of the dollar.

- It is too impractical to end the Fed without creating economic instability, so another plan is needed.

The Smith Family Foundation hosts a very similar debate with George Selgin, Peter Schiff, Steven Axilrod (former member of the Federal Reserve's Board of Governors), and a political science professor from Columbia University:

I just want to point out that at minute 58 Axilrod exposes the political interests of the Fed and its Board of Governors.

Why shouldn't we audit the Fed?

Too Big To Bail makes the case that to audit the Fed is essentially to end it, and we should not forget that ultimately it was Congress that created the Federal Reserve system and as such they should be blamed for it. In other words, we are to blame for it, and blaming Bernanke and the Fed for our woes is misplaced anger. As he states,

Don’t get me wrong. I think the idea of a Fed and fiat currency, are bad ideas. I just think we should stop the classic congressional game where we create a problem and then complain about the Fed as if they are to blame. We created the beast and now are not happy with it. We can pull the plug whenever we want. But doing so would be an admission that we screwed up, not the Fed. The issues everyone has seems to be with the institution per se. And we created the institution.

So within the very framework that we set up, the Fed’s argument in favor of independence seems to make perfect sense. Of course, I question the whole framework, but given the situation, it does make sense.

Fed Chairman Ben Bernanke speaks on the issue, and claims that the audit would nullify Fed independence -

And from his article in the WSJ:

The Congress, however, purposefully--and for good reason--excluded from the scope of potential GAO reviews some highly sensitive areas, notably monetary policy deliberations and operations, including open market and discount window operations. In doing so, the Congress carefully balanced the need for public accountability with the strong public policy benefits that flow from maintaining an appropriate degree of independence for the central bank in the making and execution of monetary policy. Financial markets, in particular, likely would see a grant of review authority in these areas to the GAO as a serious weakening of monetary policy independence. Because GAO reviews may be initiated at the request of members of Congress, reviews or the threat of reviews in these areas could be seen as efforts to try to influence monetary policy decisions. A perceived loss of monetary policy independence could raise fears about future inflation, leading to higher long-term interest rates and reduced economic and financial stability. We will continue to work with the Congress to provide the information it needs to oversee our activities effectively, yet in a way that does not compromise monetary policy independence.

The Washington Post also thinks auditing the Fed is dangerous:

Though the bill has attracted 276 co-sponsors in the House and 17 in the Senate, it is wrongheaded in the extreme. By opening up the Fed's most sensitive interest rate and credit policies to public second-guessing, the bill would create a risk -- real and perceived -- of monetary policy bent to suit congressional overseers. This would destroy financial markets' faith in the Fed and, by extension, the value of the U.S. dollar, just as surely as a political "audit" of the Supreme Court's deliberations would undercut public faith in the justice system. ... The Federal Reserve Transparency Act is an unserious answer to a serious question.If I may, the serious question is the existence of the Federal Reserve itself. As I find more sources I will update this post and continue to compile them. I hope this is a good start for you, though.

Wednesday, July 22, 2009

Unintented Consequences with Walter Williams

These videos do a great job exploring the themes of Henry Hazlitt's "Economics in One Lesson". The barrier to entry that is minimum wage, unintended consequences of government intervention in markets, and the deleterious effects of welfarism on the human spirit.

Wednesday, July 15, 2009

Universal Health Insurance - Government "Option"?

"The House is also proposing a mandate on Americans above a certain income level: People would be penalized as much as 2.5 percent of their income for failure to buy health insurance."Isn't that convenient? Is there a business on the planet that wouldn't take advantage of the ability to levy a penalty on its non-customers for not choosing their product? How can ANYBODY claim that the Federal Government insurance plan will "compete" with private insurance companies when consumers are now penalized for not purchasing a plan?

If the government option is cheaper, everyone who is mandated to buy will likely choose that plan. This is about as competitive as putting ex-lax in the other teams' water cooler before hitting the field.

Imagine Best Buy telling Americans, "If you don't buy our TVs, DVDs, and video games, we'll send you a bill for 2.5% of your income." Of course, no one would pay that bill. Until Best Buy put out a warrant for your arrest...

Tuesday, July 14, 2009

Who owns the Fed?

Here's what the Fed has to say about the matter:

"The Federal Reserve System is not "owned" by anyone and is not a private, profit-making institution. Instead, it is an independent entity within the government, having both public purposes and private aspects."Maybe it is just me but that is confusing. Why is "owned" in quotations? So it is not a profit-making institution, but an independent entity within the government. If that is the case, why did a Federal District Court in California rule that the Federal Reserve is a private corporation? See here:

"Plaintiff, who was injured by vehicle owned and operated by a federal reserve bank, brought action alleging jurisdiction under the Federal Tort Claims Act. The United States District Court for the Central District of California, David W. Williams, J., dismissed holding that federal reserve bank was not a federal agency within meaning of Act and that the court therefore lacked subject-matter jurisdiction. Appeal was taken. The Court of Appeals, Poole, Circuit Judge, held that federal reserve banks are not federal instrumentalities for purposes of the Act, but are independent, privately owned and locally controlled corporations."It is worthwhile to read the ruling in its entirety, but "independent, privately owned and locally controlled corporations" doesn't seem to jive with "an independent entity within the government". Maybe the District Judge was confused. I certainly am. Lets see if this handy chart from the Richmond, VA Fed can help us...

And further,

"Each Federal Reserve Bank is a separate corporation owned by commercial banks in its region. The stockholding commercial banks elect two thirds of each Bank's nine member board of directors. The remaining three directors are appointed by the Federal Reserve Board."

And,

"Examining the organization and function of the Federal Reserve Banks, and applying the relevant factors, we conclude that the Reserve Banks are not federal instrumentalities for purpose of the FTCA (Federal Tort Claims Act), but are independent, privately owned and locally controlled corporations."

So the member banks (commercial banks like Citi, JP Morgan, etc.) are the shareholders in the local Federal Reserve banks, and they appoint two-thirds of the board of directors which manage the local banks. Each banks' board of directors appoints a president, five of whom in turn sit on the Federal Open Market Committee. Stop me when I hit public ownership land, by the way. The Federal Open Market Committee is comprised of five presidents from regional banks, and seven members of the Board of Governors. The Board of Governors is appointed by the President and confirmed by the Senate. The Board of Governors appoints the other third of the board of directors at local Federal Reserve banks, and is advised by a Federal Advisory Council comprised of a representative from each of the twelve regional banks.

Aside from all the confusion, I don't see any public ownership in there at all. There is some public representation - the Board of Governors and their appointment of 1/3 of each banks' board of directors. That is not much. Anyway, who owns the Fed?

Here is an excerpt from an article written by former N.Y. Attorney General Eliot Spitzer on the cozy relationship between the N.Y. Fed and Wall St: (italics mine)

Spitzer appears to be suggesting that Geithner works more for Wall St. than he does for the Fed. This quasi-conspiracy theory about Geithner is also advanced by former Assistant Treasury Secretary Paul Craig Roberts (@ 2:50) :"Given the power of the N.Y. Fed, it is time to ask some very hard questions about its recent performance. The first question to ask is: Who is the New York Fed? Who exactly has been running the show? Yes, we all know that Tim Geithner was the president and CEO of the N.Y. Fed from 2003 until his ascension as treasury secretary. But who chose him for that position, and to whom did he report? The N.Y. Fed president reports to, and is chosen by, the Fed board of directors.

So who selected Geithner back in 2003? Well, the Fed board created a select committee to pick the CEO. This committee included none other than Hank Greenberg, then the chairman of AIG; John Whitehead, a former chairman of Goldman Sachs; Walter Shipley, a former chairman of Chase Manhattan Bank, now JPMorgan Chase; and Pete Peterson, a former chairman of Lehman Bros. It was not a group of typical depositors worried about the security of their savings accounts but rather one whose interest was in preserving a capital structure and way of doing business that cried out for—but did not receive—harsh examination from the N.Y. Fed."

The Federal Reserve system has all the pomp and veneer of a government institution:

- The name implies a Federal agency

- The public face, Chairman of the Board of Governors, is appointed by the President

- It was created in name of the "public interest", to protect the value of the dollar and provide economic stability

- Has regulatory power over other private corporations

- Non-profit organization

- Has a special .gov web address

Support Ron Paul's bill to audit the Fed. Why? 'Cause he pwns the Fed!

Wednesday, July 8, 2009

What is wrong with this picture?

Monday, July 6, 2009

Does Capitalism Work?

What system can generate such a circumstance? How can comparatively small states like New Jersey can produce more than the geographical area of Russia? Is it merely that New Jersey has more natural resources than all of Russia? Or that the people of New Jersey are smarter than the people of Russia? Or is it related to each states' respective proximity to the natural state of liberty?

From the index of economic and political freedom:

"State involvement in economic activity remains considerable, and institutional constraints on economic freedom are severe. Non-tariff barriers add significantly to the cost of trade. Inflation is high, and prices are heavily controlled and influenced by the government. Virtually all foreign investment faces official and unofficial hurdles, including bureaucratic inconsistency, corruption, and outright restrictions in lucrative sectors like energy. Corruption weakens the rule of law and increases the fragility of property rights and the arbitrariness of law enforcement."The answer is quite simple - the government acts as an obstacle to natural market activity. Price controls and excessive bureaucracy prevent individuals from disposing of their property how they see fit. A weakened rule of law and barriers to trade stifle risk taking and entrepreneurship. All of these things lower productivity. The truth becomes clear - it does not matter how many natural resources a country has, nor how intelligent the population is. If government will not allow people to trade freely with each other, guarantee the security of property and establish the rule of law, productivity and quality of life will suffer.

Thomas Jefferson, George Washington, and the rest of the founders took a different approach. They recognized both the economic and personal woes that emerge from a bloated State. The United States was founded on the principles of individual liberty and the rule of law, precisely what is lacking in Russia. Capitalism works, and one need to look no further than to compare New Jersey to Russia.

* It should be noted that New Jersey outproduces Russia despite being one of the most heavily taxed and regulated State's in the Union.

Wednesday, July 1, 2009

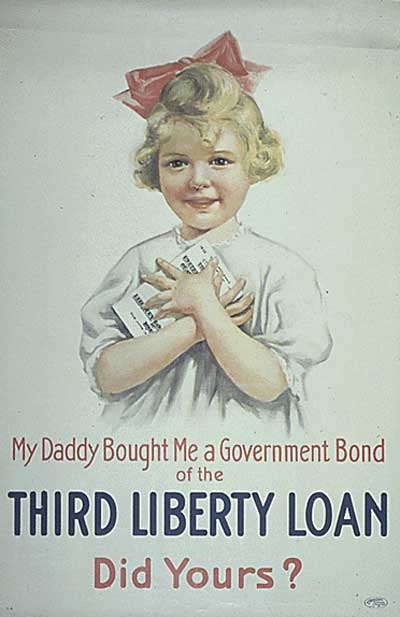

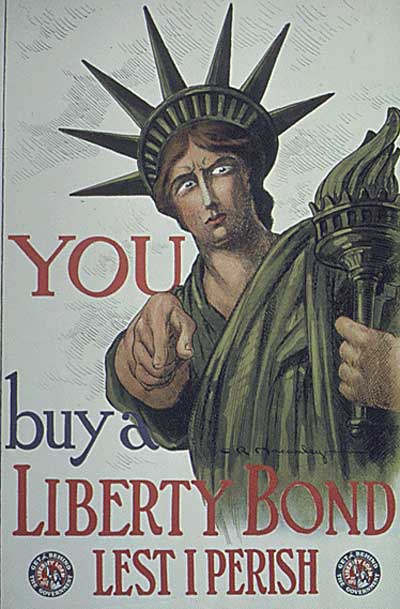

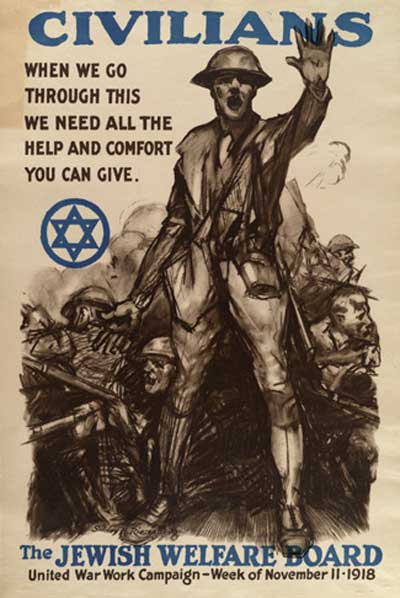

Propaganda Art Show (July 2009)

Some videos for thought

This man has some interesting insights into market behavior, inflation and deflation, and China's currency policy. No really, it is interesting!

State Capitalism (or fascism) in the USA

Murray Rothbard speaking in 1989 on "The Current State of World Affairs"

Enjoy!